Best Mortgage Lenders in the USA (2026)

Securing the right mortgage lender is a foundational step in the homebuying process. For most Americans, a mortgage loan represents the single largest financial obligation they will ever assume. The structure of your loan—interest rate, term length, fees, underwriting standards, and servicing quality—can materially affect your total cost of homeownership over decades.

In 2026, the U.S. mortgage market is characterized by increased competition, digital transformation, and more borrower-centric underwriting models. After periods of rate volatility earlier in the decade, lenders are competing aggressively on pricing, closing speed, and borrower experience. Consumers now benefit from a broader array of products, enhanced online tools, and more transparent rate comparisons.

This guide analyzes several of the most reputable mortgage lenders in the United States for 2026, outlining their competitive advantages, ideal borrower profiles, and distinguishing features within today’s lending environment.

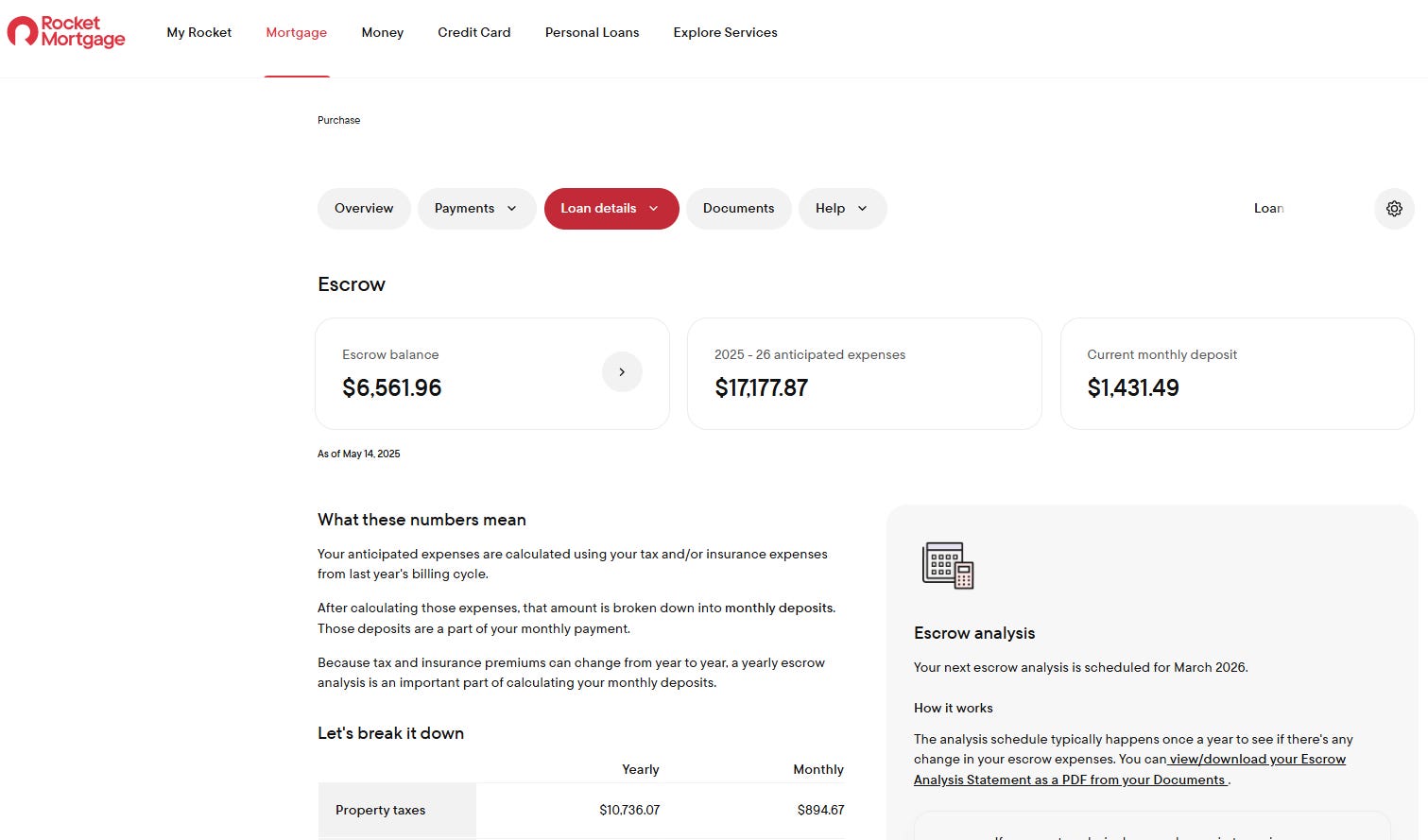

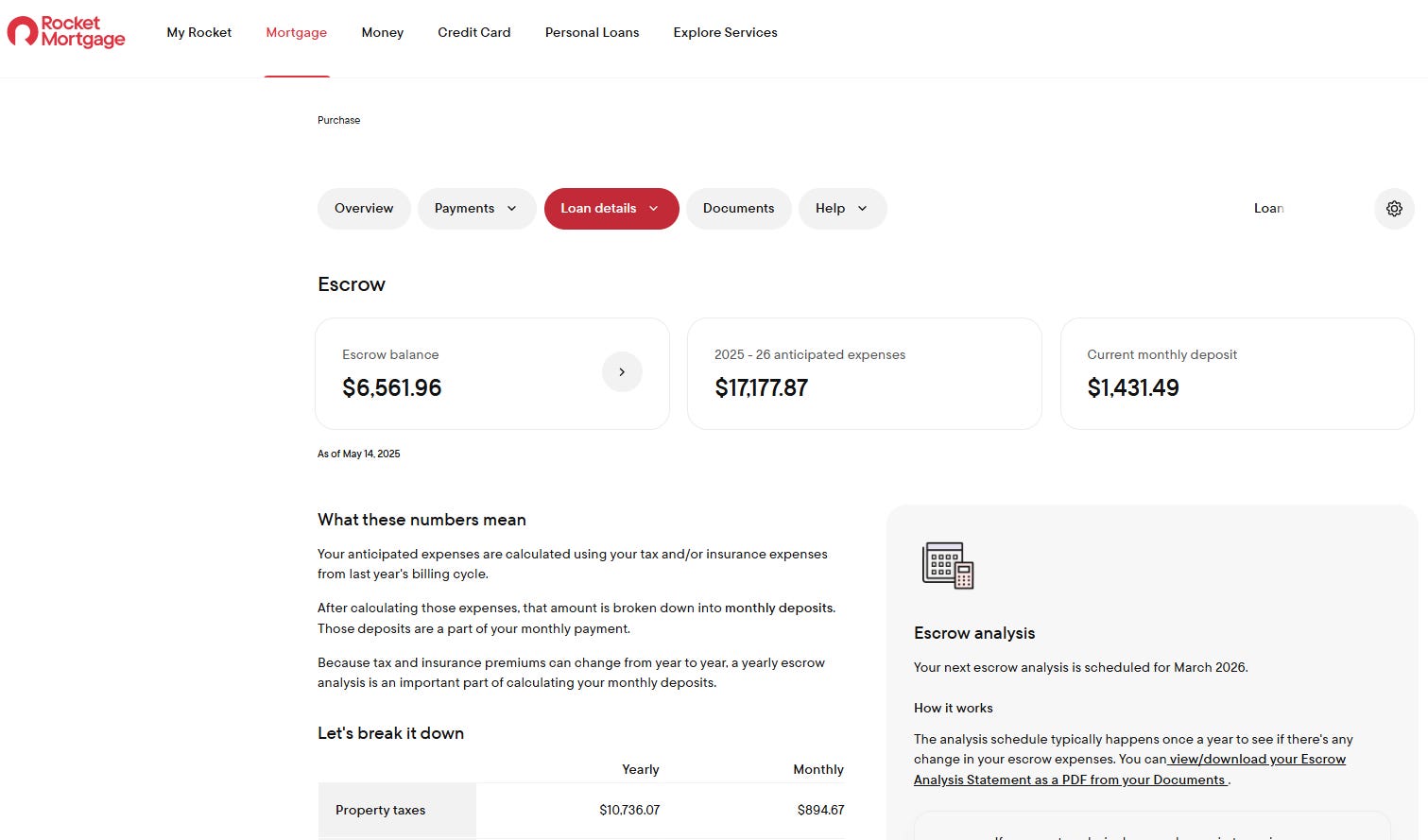

1. Rocket Mortgage – Best Overall Mortgage Lender

Rocket Mortgage remains one of the most recognized and dominant mortgage originators in the United States. As the digital lending arm of Rocket Companies, it has built its brand around speed, automation, and borrower convenience.

Why It Stands Out

- Digital-first platform: The entire mortgage application process—from pre-approval to closing—can be completed online.

- High origination volume: A large lending footprint reflects operational scalability and brand trust.

- Broad loan portfolio: Conventional, FHA, VA, jumbo, and refinancing options.

- Strong user experience: Borrowers can upload documents, e-sign disclosures, and track loan status in real time.

Rocket Mortgage is particularly attractive to:

- Tech-savvy borrowers

- First-time homebuyers who want guided digital workflows

- Refinancers seeking streamlined processing

While origination fees may be slightly higher compared to smaller regional lenders, many borrowers find the efficiency and transparency justify the cost. Its structured digital interface minimizes paperwork friction and accelerates underwriting timelines.

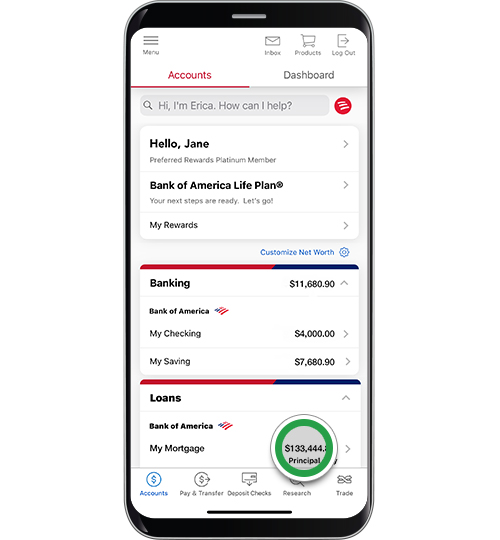

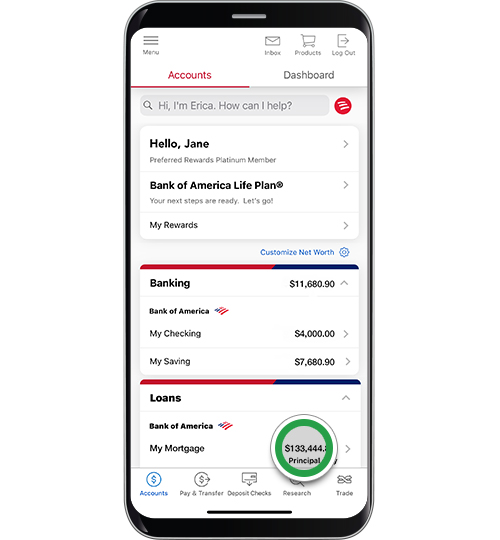

2. Bank of America – Best for Nationwide Coverage

Bank of America combines national scale with physical branch access, offering a hybrid lending model that appeals to borrowers who value both digital convenience and in-person support.

Key Strengths

- Nationwide presence

- Extensive branch network

- Integrated banking ecosystem

- Competitive down payment programs

The bank offers:

- Conventional fixed- and adjustable-rate mortgages

- FHA and VA loans

- Low down payment programs

- Special affordability initiatives in select markets

For existing Bank of America customers, relationship-based pricing discounts may be available. The bank’s digital mortgage portal allows borrowers to:

- Lock rates online

- Upload documents securely

- Track underwriting progress

- Communicate directly with loan officers

Borrowers who prefer structured guidance from a major financial institution—particularly those who already bank with Bank of America—often find this lender compelling.

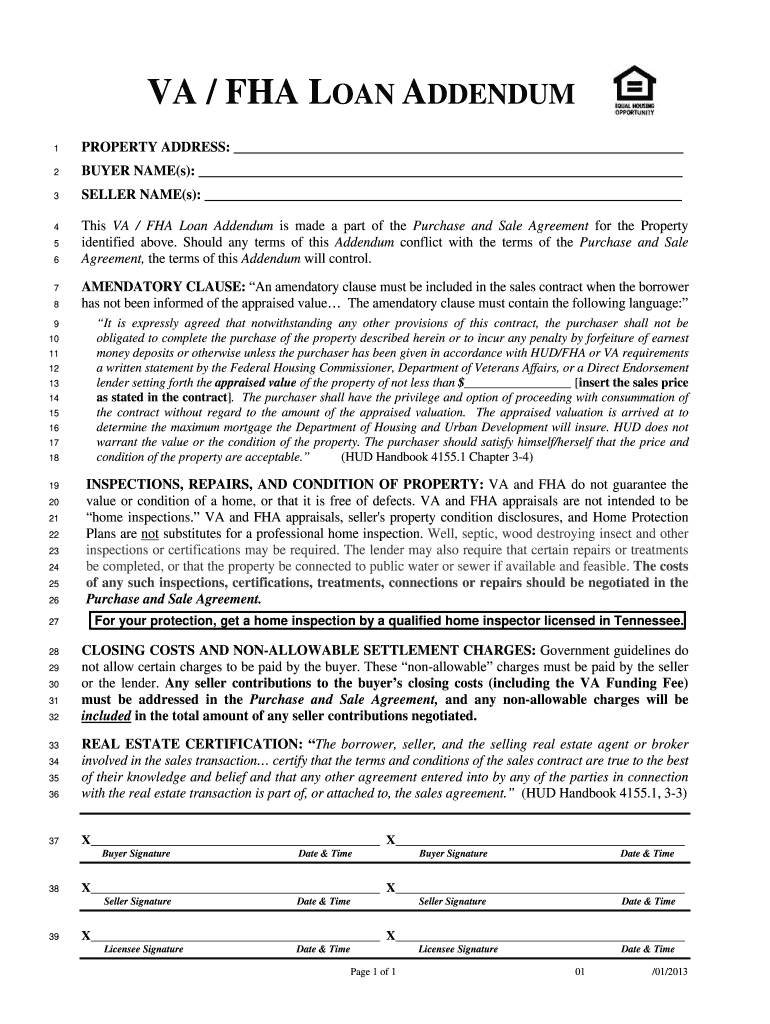

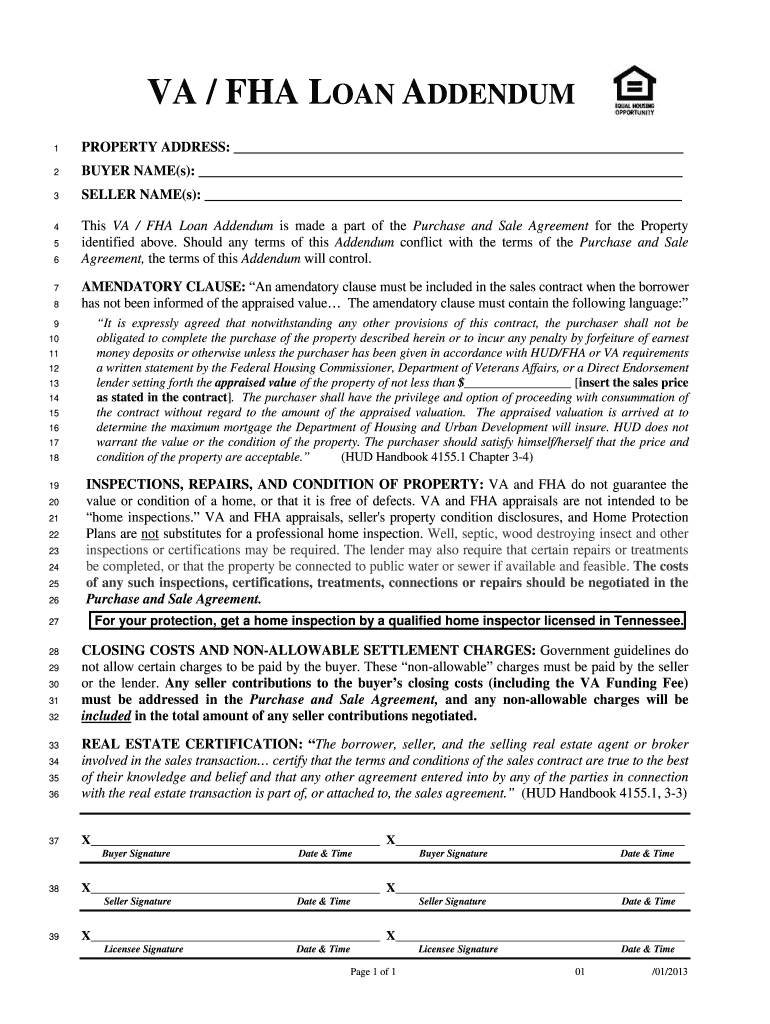

3. Veterans United Home Loans – Best for VA Loans

Veterans United Home Loans specializes in VA mortgage products, serving active-duty military members, veterans, and eligible surviving spouses.

Why It Leads in VA Lending

- Deep institutional expertise in VA underwriting

- Strong customer service ratings

- Competitive VA loan rates

- Educational resources tailored to military borrowers

VA loans offer distinct advantages:

- No down payment (in most cases)

- No private mortgage insurance (PMI)

- Flexible credit guidelines

- Competitive interest rates

Because VA loans have unique appraisal, entitlement, and eligibility rules, specialization matters. Veterans United’s loan officers are specifically trained in VA program intricacies, which often results in smoother approvals and fewer administrative delays.

For eligible borrowers, this lender consistently ranks as a top-tier option in 2026.

4. NBKC Bank – Best for First-Time Homebuyers

NBKC Bank has earned recognition for transparency, competitive pricing, and borrower-friendly terms. It is especially attractive to first-time homebuyers navigating the mortgage process for the first time.

Core Advantages

- Competitive interest rates

- Low origination fees

- Simplified loan options

- Flexible credit requirements

First-time buyers often need:

- Clear explanations of loan terms

- Affordable closing costs

- Pre-approval guidance

- Assistance comparing fixed vs. adjustable-rate options

NBKC’s straightforward pricing model reduces hidden fee concerns, and its emphasis on cost transparency makes budgeting more predictable. Borrowers with moderate credit profiles may find its underwriting standards more accessible than larger national banks.

5. PennyMac – Best for Government-Backed Loans

PennyMac specializes in both loan origination and servicing, with particular strength in government-backed mortgage programs.

Loan Types Offered

- FHA loans

- USDA rural development loans

- VA loans

- Conventional loans

Government-backed loans are designed for:

- Borrowers with lower credit scores

- Buyers with limited down payments

- Rural or suburban homebuyers

- Moderate-income households

PennyMac’s experience in FHA and USDA underwriting makes it especially valuable for borrowers who may not qualify for conventional financing. Its loan servicing infrastructure also allows borrowers to manage payments, escrow, and refinancing options efficiently after closing.

6. Citizens Bank and PNC Bank – Best Regional Bank Options

Regional banks such as Citizens Bank and PNC Bank offer a balanced alternative between national lenders and small local institutions.

Advantages of Regional Banks

- Competitive rate structures

- Personalized loan consultations

- Local market expertise

- Relationship-based banking benefits

Borrowers who prefer face-to-face interactions often appreciate regional lenders. These banks frequently provide tailored solutions based on local housing market conditions and may offer flexible underwriting for established customers.

While their national origination volumes may be lower than large digital lenders, their customer engagement and individualized service can be superior for borrowers who value a consultative approach.

How to Choose the Right Mortgage Lender in 2026

Selecting the best lender requires a strategic evaluation of your financial profile and long-term housing objectives.

1. Compare APR, Not Just Interest Rate

The Annual Percentage Rate (APR) reflects the true cost of borrowing, including lender fees and discount points.

2. Evaluate Loan Type Compatibility

- Conventional loans: Ideal for strong credit and higher down payments

- FHA loans: Designed for lower credit profiles

- VA loans: Exclusive to military-affiliated borrowers

- USDA loans: Target rural properties

3. Assess Service Model Preferences

- Digital-only experience → Consider Rocket Mortgage

- Hybrid digital + branch → Bank of America

- Military specialization → Veterans United

- Government-backed expertise → PennyMac

- Personalized local service → Citizens or PNC

4. Examine Fees and Closing Costs

Origination fees, underwriting charges, and discount points vary widely across lenders. Request Loan Estimates from at least three institutions for accurate comparisons.

5. Review Customer Satisfaction

Look at borrower reviews, complaint records, and servicing performance. A low rate means little if servicing is poor over a 30-year term.

Market Outlook for 2026

In 2026, lenders are competing on three primary fronts:

- Digital efficiency

- Rate competitiveness

- Borrower education and transparency

Automation in underwriting, AI-assisted document processing, and faster appraisal coordination are shortening closing timelines. At the same time, heightened competition has increased promotional incentives such as rate buydowns and lender credits.

Borrowers benefit most when they leverage competition—securing multiple quotes and negotiating fees.

Conclusion

The U.S. mortgage landscape in 2026 offers borrowers more choice, better digital infrastructure, and competitive pricing across lender categories.

- Rocket Mortgage leads in digital convenience and overall scale.

- Bank of America delivers nationwide reach and institutional stability.

- Veterans United Home Loans dominates VA lending.

- NBKC Bank supports first-time buyers effectively.

- PennyMac excels in government-backed programs.

- Citizens Bank and PNC Bank provide strong regional alternatives.

Ultimately, the “best” mortgage lender is not universal—it depends on your credit profile, income stability, down payment capacity, geographic location, and preferred service experience. Conduct structured comparisons, analyze Loan Estimates carefully, and consult financial professionals when necessary to secure financing aligned with your long-term wealth-building goals.

Rocket Mortgage remains one of the most recognized and dominant mortgage originators in the United States. As the digital lending arm of Rocket Companies, it has built its brand around speed, automation, and borrower convenience.

Rocket Mortgage remains one of the most recognized and dominant mortgage originators in the United States. As the digital lending arm of Rocket Companies, it has built its brand around speed, automation, and borrower convenience.

Bank of America combines national scale with physical branch access, offering a hybrid lending model that appeals to borrowers who value both digital convenience and in-person support.

Bank of America combines national scale with physical branch access, offering a hybrid lending model that appeals to borrowers who value both digital convenience and in-person support.

Veterans United Home Loans specializes in VA mortgage products, serving active-duty military members, veterans, and eligible surviving spouses.

Veterans United Home Loans specializes in VA mortgage products, serving active-duty military members, veterans, and eligible surviving spouses.

NBKC Bank has earned recognition for transparency, competitive pricing, and borrower-friendly terms. It is especially attractive to first-time homebuyers navigating the mortgage process for the first time.

NBKC Bank has earned recognition for transparency, competitive pricing, and borrower-friendly terms. It is especially attractive to first-time homebuyers navigating the mortgage process for the first time.

PennyMac specializes in both loan origination and servicing, with particular strength in government-backed mortgage programs.

PennyMac specializes in both loan origination and servicing, with particular strength in government-backed mortgage programs.

Regional banks such as Citizens Bank and PNC Bank offer a balanced alternative between national lenders and small local institutions.

Regional banks such as Citizens Bank and PNC Bank offer a balanced alternative between national lenders and small local institutions.